As financial transactions undergo a transformative shift with the rise of emerging technologies, the assumption that traditional checks are declining has been challenged by a noticeable surge in check fraud.

Abstract:

As financial transactions undergo a transformative shift with the rise of emerging technologies, the assumption that traditional checks are declining has been challenged by a noticeable surge in check fraud. This article explores the complexities of this growing problem and proposes effective strategies, utilizing advanced technologies, to mitigate the risks associated with check fraud.

Introduction:

While digital payment methods have gained prominence, financial institutions are grappling with an unexpected increase in check fraud. This paper delves into the multifaceted dimensions of this issue and presents innovative solutions to counter evolving tactics employed by fraudsters.

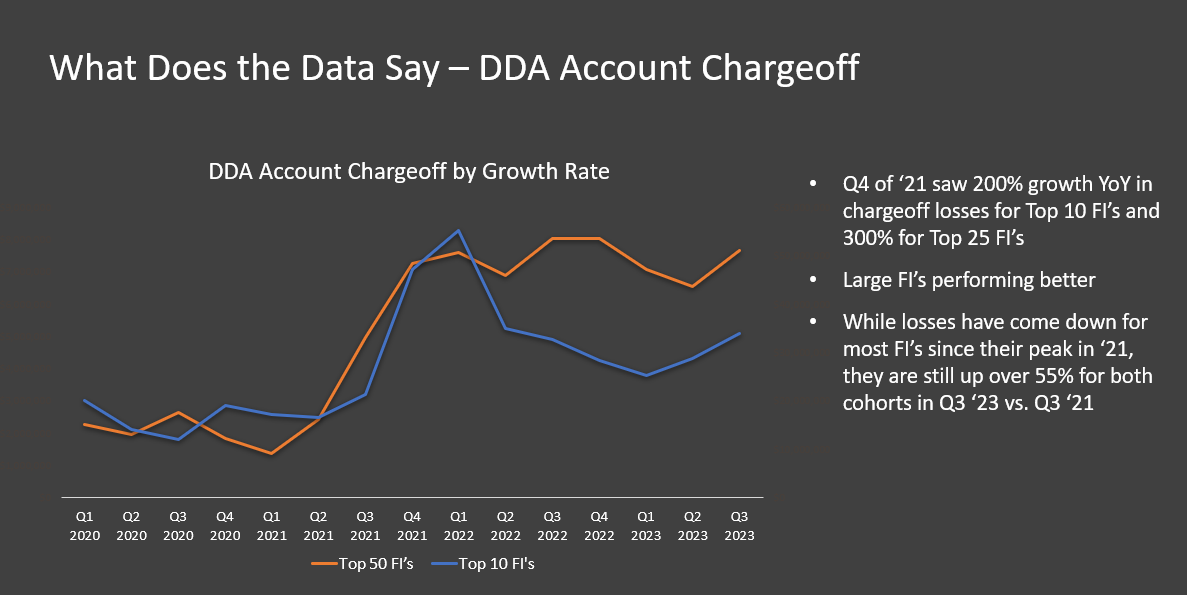

In Q4 of '21, charge-off losses grew by 200% YoY for the Top 10 FIs and 300% for the Top 25 FIs.

Large FIs show better performance, but overall losses are up over 55% for both cohorts in Q3 '23 vs. Q3 '21.

Current Trends in Check Fraud:

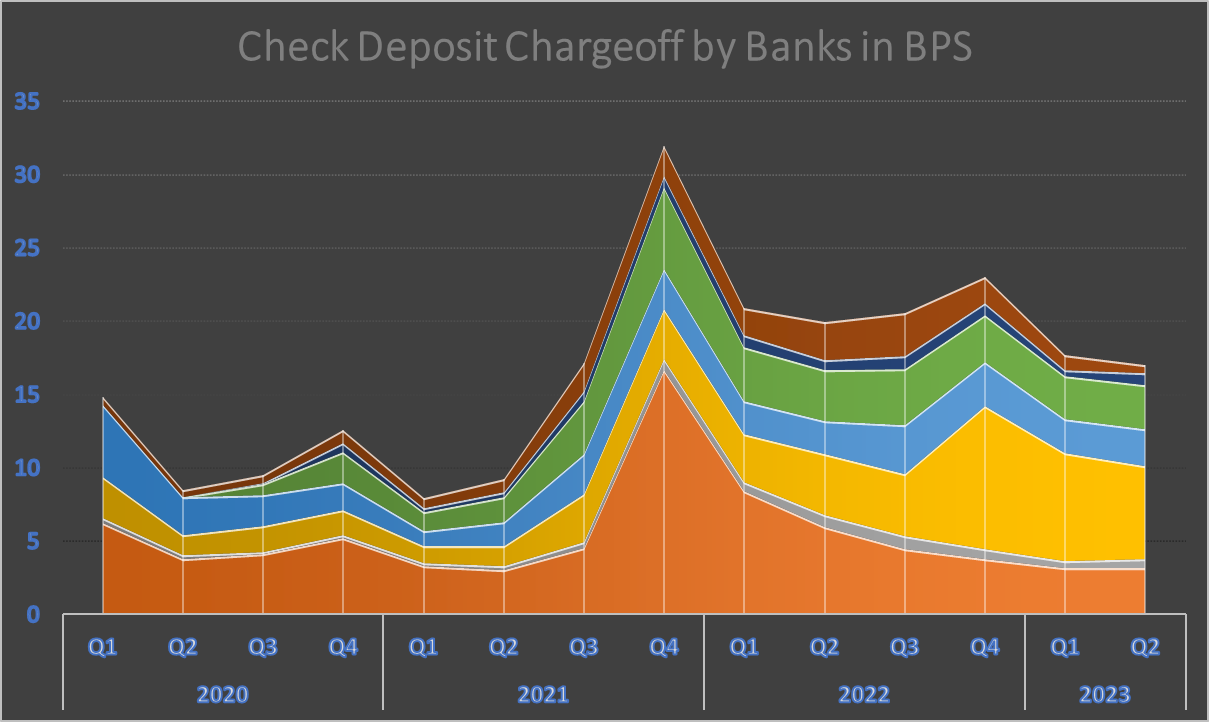

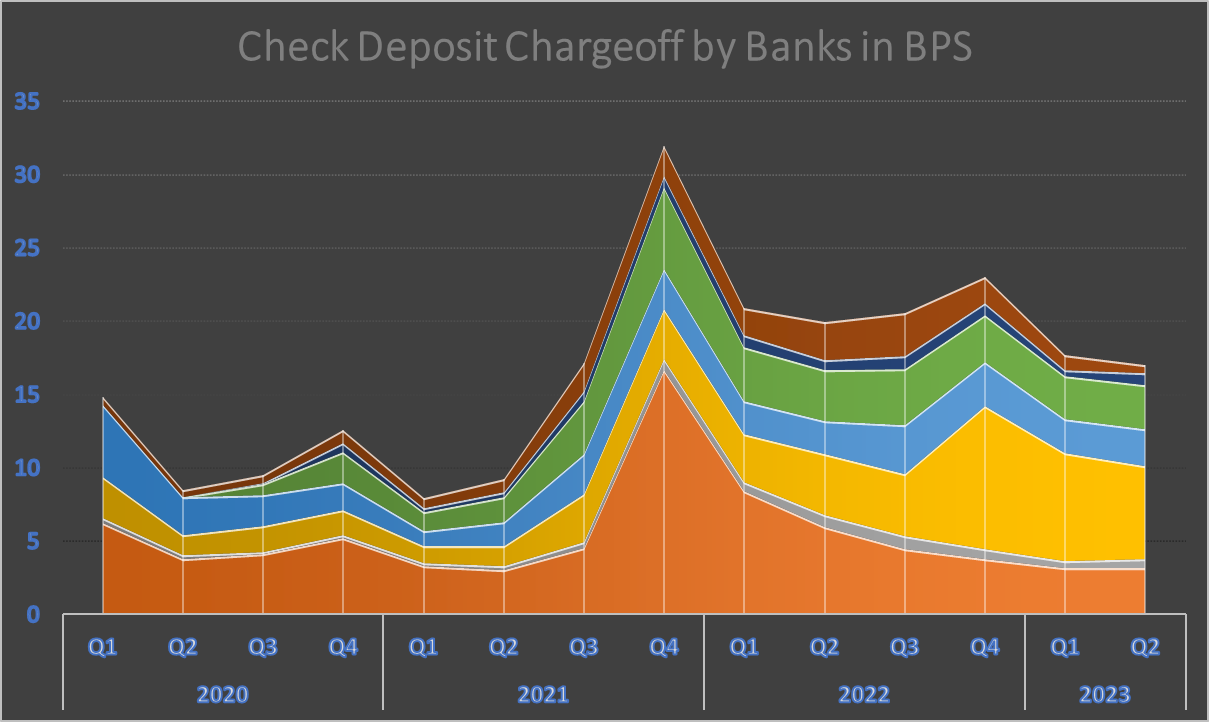

Check deposit charge-off rates increased from mid-single digits to the teens at FIs from 2020 to 2022.

Check fraud amounted to $815 million in 2022, as reported by the Senate Committee on Banking.

With elevated loss figures persisting, VALID estimates this number to easily surpass $1 billion across the industry.

- ACH Conversion Fraud: A contemporary challenge is ACH conversion fraud, where fraudsters exploit the Automated Clearing House (ACH) system to convert legitimate checks into electronic transactions, evading traditional detection methods.

- Authentication and Identity-Related Fraud: Sophisticated fraudulent activities related to authentication and identity underscore the need for a reevaluation of existing security measures.

- Check Image Exchange and Washing: Fraudsters employ check image exchange and washing techniques, emphasizing the necessity for heightened vigilance in an era where visual verification methods fall short.

Strategies for Mitigating Check Fraud:

- Behavioral Customer Account Analytics and Pattern Recognition: Implementing advanced analytics to discern customer transaction patterns and recognize deviations indicative of suspicious or risky activities.

- Real-Time Fraud Detection: Shifting from delayed reviews to real-time fraud detection enables FIs to promptly identify and address potential threats as they occur.

- Machine Learning and AI: Harnessing machine learning and artificial intelligence to analyze historical data, identify patterns, and adapt to emerging fraud trends in real-time.

- Collaborative Information Sharing (Consortium): Encouraging collaboration among financial institutions and industry stakeholders to establish a robust network for sharing information on emerging fraud threats.

- Continuous Monitoring and Analytics: Utilizing continuous monitoring of account activity, coupled with advanced analytics, to detect unusual patterns indicative of fraudulent activity.

- Cross-Channel Fraud Prevention: Implementing comprehensive fraud prevention measures across various channels to create a unified defense against check fraud.

Conclusion

Historically, banks heavily relied on image-based methods, but as fraudsters adopt new techniques, there is a need for a paradigm shift in risk management approaches. Counterfeit checks are representing a small section of check fraud and focus on image only solutions can significantly

Leading institutions like VALID invest substantially in innovative AI and machine learning solutions, providing a holistic view to identify fraud with precision.